Tougher Times, Tighter Wallets

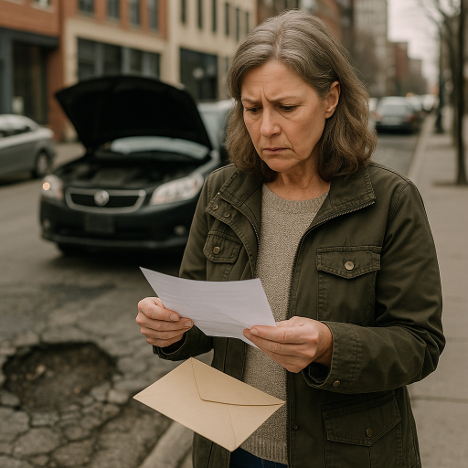

From rising grocery bills to inflated gas prices, the ripple effect of inflation continues to stretch household budgets across Canada. Even with steady employment, many working-class families and young professionals are finding it difficult to absorb unplanned expenses. Whether it’s a car repair, a medical bill, or a rent spike, sudden costs are testing financial resilience like never before.

Recent surveys show a steady increase in the number of Canadians living paycheck to paycheck—many without enough savings to handle even a modest emergency. Traditional lending options like credit cards or bank loans are often either maxed out or unavailable due to credit requirements, leaving consumers in a bind when time-sensitive situations arise.

Old Habits, New Risks

Historically, payday loans filled this urgent need. Fast, easy, and with minimal paperwork, they provided a quick fix. But over time, the reality of payday lending began to show its cracks. Short repayment windows, sky-high fees, and rollover traps made it increasingly difficult for borrowers to climb out of debt. A study by the Financial Consumer Agency of Canada found that many users of payday loans ended up in worse financial positions than before.

In today’s credit landscape, Canadians are becoming more cautious. With more information now available and increasing regulatory pressure, the demand for safer, more responsible borrowing tools has risen. This demand has opened the door for newer, more structured lending alternatives.

Emerging Lifelines in the Financial Landscape

Companies like EasyFinancial are helping bridge the gap between traditional banking and predatory payday lenders by offering short-term financial solutions that balance accessibility with responsibility. These services allow borrowers to access funds for pressing needs while maintaining transparent terms, fixed repayments, and credit-building opportunities—features that have often been missing in the payday loan industry.

One of the biggest shifts is the ability to repay loans over a longer time frame, which reduces pressure on the borrower and prevents the high-risk debt cycle common with standard payday loans. For many Canadians who have been turned down by banks due to low credit scores or inconsistent employment, these services are a practical, less punishing alternative.

Financial Professionals Weigh In

The financial sector is beginning to take notice. “It’s about time the market evolved,” says Linda Carroway, a Toronto-based financial literacy advocate. “We need borrowing tools that are humane, not just fast. The rise of alternative lending platforms that offer fixed payments and report to credit bureaus is a good step forward. People shouldn’t have to choose between their health and their credit score.”

Banks have also started to explore more inclusive lending programs, but many remain hesitant to issue unsecured loans to subprime borrowers. That’s where non-bank financial providers are filling a crucial role. “This isn’t about enabling overspending,” Carroway adds, “It’s about giving people options when life throws them a curveball.”

Real Stories from Everyday Canadians

Sandra G., a single mother from Brampton, recently faced a major dental emergency for her 8-year-old son. “I didn’t have $1,200 sitting in my account,” she recalls. “My credit card was maxed from paying for groceries. I looked into payday loans but got scared off by the reviews. I needed something I could pay off over time, not in two weeks.”

Through a friend’s recommendation, she applied online for a personal loan through a lending service that offered short-term financial solutions with flexible terms and no hidden fees. “They let me pick a repayment plan that worked with my monthly budget,” she says. “That night, my son got treated. I didn’t lose sleep over how I’d pay it back.”

Bridging Access and Accountability

One of the primary criticisms of traditional payday lenders has been their failure to report repayment behavior to credit bureaus. As a result, borrowers gain no credit-building benefit even if they repay responsibly. Forward-thinking lenders are now correcting this by integrating reporting into their systems, allowing customers to not only cover urgent costs but also build long-term financial health.

By ensuring customers are educated on repayment terms and providing financial tools like credit monitoring and budgeting tips, some of these modern lenders are offering more than just a lifeline—they’re offering a financial stepping stone.

Looking Ahead

The conversation around emergency lending is evolving. The stigma once attached to borrowing is slowly being replaced by a demand for transparency and fairness. The new generation of lending platforms are shifting the narrative, proving that fast money doesn’t have to be predatory.

That said, financial advisors continue to emphasize the importance of financial literacy. “It’s vital to read the fine print, ask questions, and know your rights as a borrower,” says Carroway. “Even with better options available, consumers should approach borrowing with a long-term mindset.”

Conclusion

As Canadians brace for continued economic uncertainty, the need for safety nets becomes more apparent. While payday loans once seemed like the only option, the rise of more thoughtful lending alternatives is changing the financial landscape. With responsible providers now offering structured plans, consumer protections, and real support, Canadians have more power than ever to weather short-term financial storms—without long-term damage.