Aerial photo of North Penn High School, center, with district transportation garage at top center, North Montco Technical Career Center at top left, and former WNPV Radio site at top right, as seen in NPTV video “NPHS – A Building By Community.” (Screenshot of NPTV video)

First phase could begin this summer

The first phase of renovations to North Penn High School drew closer this week as school board members saw details on the borrowing schedule for those renovations, and specifics of a first borrowing that could be finalized within weeks.

“What is the right amount to borrow, if any? Do we use reserves to fund the $20 million, or is there some combination between incurring debt and using reserves? Or is it all debt, all $20 million of debt?” said CFO Steve Skrocki.

School board members and staff have discussed major renovations to the high school for much of the past two years, and a voter referendum in January 2024 asked taxpayers to approve debt needed to build an addition for roughly 1,000 ninth graders to move to the high school complex.

After voters rejected that referendum, staff and the design team began work on a new design adding a smaller addition to the current campus, and have since given monthly updates on that layout and latest plans. In October the district’s financial analyst previewed the series of bond borrowings needed to fund the project, in November the board heard details of the first phase, and in December voted to seek bids for that first phase.

During the school board finance committee meeting on Tuesday night, Skrocki summarized the latest: the first phase of renovations will include renovating the current school’s three-floor K-pod of classrooms and administrative offices, the natatorium, pre-purchasing certain items with long lead times like electric switch gear, moving the propane tank and fuel station between the high school and its Crawford Stadium to a new location near the Valley Forge Road entrance, and buying and installing a pre-manufactured building for the transportation department’s bus maintenance garage, dispatch center and offices.

Early signs are positive that those bids will be competitive, the CFO told the committee: “We had a pre-bid meeting with contractors earlier this afternoon, and a great result: we were very pleased by the number of contractors that were there.”

“When contractors see a lot of interest, they see a lot of colleagues and a lot of competition in the room, this magic happens: they tend to sharpen their pencils, when they know there’s multiple other players,” Skrocki said.

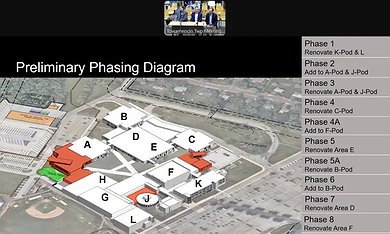

North Penn School District officials, inset, show Towamencin’s supervisors an outline of North Penn High School, the school’s various “pods” lettered, potential new additions outlined in red, and a possible renovation timeline at right, during the June 26, 2024 township supervisors meeting. (Screenshot of meeting video)

North Penn School District officials, inset, show Towamencin’s supervisors an outline of North Penn High School, the school’s various “pods” lettered, potential new additions outlined in red, and a possible renovation timeline at right, during the June 26, 2024 township supervisors meeting. (Screenshot of meeting video)That phase is estimated to cost roughly $29 million, and bids are expected to be opened on Jan. 30, with staff then recommending a bid award to the board for a vote in February. Construction could start in May 2025 and run into summer 2026.

“So you won’t spend the entire $29 million in the year 2025: the estimate, per the draw schedule, is we’re going to spend about $20 million in 2025,” he said. “The question for tonight is: How are we going to come up with that money?”

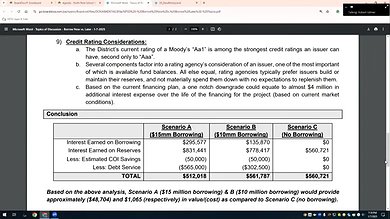

Financial analyst Zach Willard of PFM Financial Advisors outlined three options his firm analyzed: whether to borrow $15 million in 2025, to borrow $10 million, or to borrow zero, and to fund the entire $20 million out of reserves.

Borrowing more could allow the district to earn more on short-term investments while the funds are held and before they’re spent, while borrowing less and using reserves could cut long-term costs, but could also impact the bond rating.

Another consideration is that borrowing at or under the $10 million threshold could yield a better interest rate due to “bank qualified” status, and a shorter call period which could let the district refinance sooner if interest rates drop.

“You’re not going to spend all the money at once, so when you borrow that money, you’re going to invest that money,” Willard said, before showing a chart of the possible short-term interest earnings.

Chart depicting possible scenarios for borrowing $15 million, $10 million, or zero to fund the first phase of renovations to North Penn High School in 2025, as presented to North Penn’s finance committee meeting on Tuesday, Jan. 7, 2025. (Screenshot of NPTV video)

Chart depicting possible scenarios for borrowing $15 million, $10 million, or zero to fund the first phase of renovations to North Penn High School in 2025, as presented to North Penn’s finance committee meeting on Tuesday, Jan. 7, 2025. (Screenshot of NPTV video)Based on current rates and projected future interest rate cuts, borrowing $15 million would yield roughly $295,000 in interest earnings through the end of 2025, while the $10 million borrowing would yield roughly $135,000 in earnings, while the zero borrowing option would have no interest earnings on any borrowing.

An additional $21 million was identified by staff as surplus funds from the 2023-24 budget and allocated by the board for capital projects, Willard added; including those funds would bring the total interest earnings to just over $831,000 for the $15 million borrowing; $778,000 for the $10 million borrowing, and about $560,000 for interest on those funds with no additional borrowing, he said. Adding the interest earnings and subtracting the debt service payments yield almost identical numbers for all three options — a net surplus of $512,000 for the $15 million borrowing; of $561,000 for the $10 million borrowing, and $560,000 for the zero borrowing option.

“You have a fantastic rating, a AA1. The goal here is to maintain the credit rating,” Willard said. “One of the largest, and most important pieces, of the credit rating is what type of reserves do you have?”

As of June 30, 2024, the period covered in the district’s last audit, the district had a total of $49 million in reserves for capital projects, and a ten-year capital plan totaling $175 million for infrastructure projects needed across the district, including the high school and elsewhere. $2.7 million is assigned for healthcare costs, $22.5 million is unassigned, and Skrocki said those $49 million reserves have been allocated with a goal of keeping the district’s current AA1 bond rating.

“I’ve said publicly many times: were it not for this $260 million project, I would concur with an argument that our funds in reserves are too high. But we have a $260 million project, we’ve known about it for a long time,” Skrocki said.

Board President Cathy McMurtrie said her preference was for the $10 million borrowing with the shorter call period, while board member Jonathan Kassa said he was leaning toward the lager borrowing to secure more funds early, and said a year-end surplus for the fiscal year 2024-25 could further help.

“Perhaps we owe a ‘Thank you’ to the Fed, because their lack of cutting (interest rates) last year and this year has allowed us a little more flexibility,” Skrocki said.

The finance committee voted unanimously to recommend the parameters resolution for full board approval on Jan. 23, and Skrocki said he’d provide an update at the next finance committee meeting on Feb. 11.

North Penn’s full board next meets at 7 p.m. on Jan. 23 at the district Educational Services Center, 401 E. Hancock Street; for more information visit www.NPenn.org.

This article appears courtesy of a content share agreement between North Penn Now and The Reporter. To read more stories like this, visit https://www.thereporteronline.com