You are in the unique situation of needing to be an expert at managing the day-to-day operations of your small company as its owner. As the company's visionary, you must also devote time to creating business plans, expanding your clientele, marketing your offerings, and guaranteeing sufficient cash sources in addition to tax preparation and adherence. Because of this, you need a Certified Public Accountant (CPA) to manage the financial side of your company in order to relieve some of the pressure that currently rests on your already heavy shoulders. In this regards, es.cpa is a firm where you can find one solution under one roof.

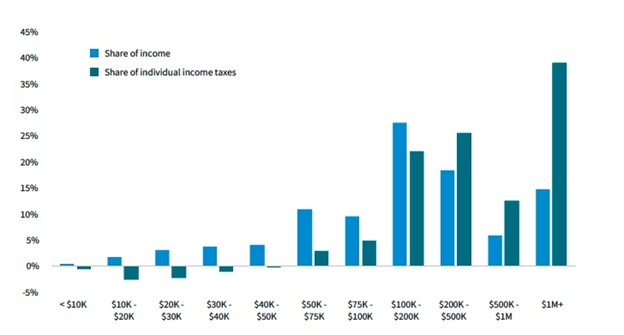

The individual income tax system in America is progressive, meaning that the greater your income, the higher your tax rate. Conversely, tax exemptions and credits often assist lower-income taxpayers more.

The proportion of federal individual income tax paid by those earning above $200,000 in 2019 was greater than their share of total income received. Individuals earning above $1 million annually, for instance, received 15% of all income but were required to pay 39% of all federal individual income taxes.

The highest marginal tax rate, however, does not provide all the information. The Tax Reform Act of 1986 (TRA86), for instance, lowered the highest marginal tax rate from 50% to 28%, which disproportionately reduced the tax burden on those with higher incomes. One may see the tax cuts as a reduction in progressivity. On the other hand, the lower income earners' tax burden was lessened by the TRA86, which increased the levels of personal exemptions and basic deductions and increased the earned income tax credit (EITC). 5.9 million Working poor people would thus either pay no taxes at all or get refunds.

Households in the lowest income quantiles in 2018 had an average total federal tax rate of 0%, down from 12.1% in 1984, rather than the marginal individual income tax rate, according to statistics on average tax rates. 2018 saw a half-reduction in the average federal tax rates paid by households in the second lowest income quintile, from nearly 15 percent to 8.1 percent.

Tax planning is a proactive method that entails anticipating needs and proactively identifying and implementing work-reducing measures. It involves figuring out your customers' financial objectives and evaluating their existing tax status. You can also ask your client to opt for charitable planning services or making charitable contributions to get a tax write off.

It's critical for tax preparers to stay current on tax regulations. It resembles keeping up with the most recent regulations of the game. It's not just wise to do so; it's required. You must guide your clients through the complexities of tax rules since they rely on you to handle their tax responsibilities. The tax system is always changing, and new laws may have a big impact on your customers' tax obligations.

To provide your customers with the greatest advise possible, you must therefore make sure you have access to the most recent and correct information. Making it a habit to check for changes can help you stay up to date, retain your knowledge, and help customers succeed financially.

By subscribing to reliable tax publications and newsletters, attending tax seminars and conferences, and participating in tax professional groups to network and exchange information with peers, you may stay informed about the most recent tax developments and expand your expertise.

The process of planning and preparing taxes has been simplified by tax software and automation. By helping you to correctly and timely prepare and submit your clients' taxes, tax software streamlines the process.

To effortlessly reduce manual data input mistakes, you may interface your tax software with numerous accounting programs to import financial data. For example, the procedure may be made simpler by simply syncing any reporting program with tax software like ATX.

It's crucial to routinely review your customers' company structures to make sure they continue to be tax-efficient as their companies grow and tax laws change. Businesses must evaluate and improve their organizational structures as they adjust to changing market dynamics and technology breakthroughs in order to reduce their tax obligations.

To maximize tax efficiency, liability protection, and management flexibility, you may carry out a comprehensive analysis of the client's company activities, evaluating their present structure and investigating alternative solutions. In order to help them make an educated choice, take into account their unique tax status as well as the possible advantages and disadvantages of each alternative.

CPAs, no doubt, own a plethora of private papers that are exchanged several times within the team in addition to being restricted to clients. Thus, you must ensure that the client's data is securely kept on any platform, including tax software.

With strong security measures in place, cloud-based accounting has emerged as a potent tactic for protecting your clients' private financial data. You may work remotely and efficiently communicate with customers thanks to cloud-hosted accounting software like QuickBooks, which makes accounting data accessible from any location with an internet connection.

This occurs when your data is being stored in safe data centers with many layers of security, such as encryption and frequent backups.

Offering small company CFO services is only one of your many responsibilities as a CPA. Another is to aggressively seek out and implement tax benefits and incentives that may greatly benefit your customers. Government-sponsored initiatives known as tax credits and incentives serve to incentivize certain investments, activities, or behaviors by lowering taxable income. You must be aware of their qualifying standards in order to assist customers in maximizing their tax benefits and reaching their financial objectives.

First, to keep informed about new tax credits and incentives, check government websites, IRS publications, and tax professional resources frequently. Next, take proactive steps to find any tax credit and incentive possibilities by going over your client's financial data and business operations.

Understanding the distinctions between these titles and what they signify in terms of credentials will help you choose the best financial assistance provider in Austin for your requirements. When it comes to complicated financial issues and compliance, a certified public accountant in Austin can provide a level of knowledge and confidence that is invaluable. CPAs are qualified to assist the expansion and financial stability of your company because of their strict license, educational requirements, and ethical standards.

It is impossible to overestimate the significance of having a strong financial foundation in Austin, a vibrant city where innovation and tradition coexist. A certified public accountant (CPA) is essential when managing the complexity of tax regulations, trying to maximize your company's operations, or making long-term plans.

Pace CPA distinguishes itself not just as an accounting services supplier but also as a business partner that cares about your company's development. Our strategy is based on comprehending your particular demands and efficiently customizing our services to satisfy them. Every Austin Company, in our opinion, should have a CPA who is a strategic counselor as well as a number cruncher.