North Penn School District CFO Steve Skrocki, inset, shows a bar chart depicting district interest earnings from 2010-11 to 2022, during the school board’s March 22, 2022 finance committee meeting. (Screenshot of NPTV video)

Bond rating could be boosted by higher reserves, says CFO

A new fiscal year, and an unexpected boom, have left the North Penn School District with a big decision to make. What should the district do with an unexpected surplus, which could be upwards of $20 million, from 2023-24?

“When we were doing our budget, for the ’23-24 year, think back to April or May of 2023. The projections were that the Fed was going to start cutting (interest) rates aggressively, and we reflected that in our budget,” said district CFO Steve Skrocki.

“Rates did not go down at all, so we were the benefactor of rates of 5.5 percent the entire fiscal year, which generated an additional $5.2 million in revenue, beyond what we had budgeted. This presents an interesting dilemma, these positive numbers,” he said.

Each year, after the district’s fiscal year ends on June 30, staff work with an outside firm to finalize an audit for the newly-ended fiscal year, then ask that the school board transfer surplus funds elsewhere. In recent years, those transfers have gone into the capital reserve fund to help tackle the district’s long-term capital list of smaller building projects needed around the district, or into the general fund balance, which staff have said could help boost the district’s bond rating for future borrowings. During the board finance committee meeting on Sept. 10, Skrocki outlined the early figures available from 2023-24, and decisions needed this fall.

“Our audit started this week, and right now our latest projections show us having unspent funds, in the general fund in ’23-24, of about $8.2 million. That’s about a 2.64 percent variance — higher than we typically like,” Skrocki said, compared to the usual one percent variance staff shoot for each year.

“On the revenue side, we knew this number was going to be large, in particular because of investment income: we have a positive variance of revenues of $14.2 million. That’s a 4.58 percent variance. $5 million of that alone was because of investment income,” he said.

Transferring the unspent funds will likely need to be done in October, so the transfers can be documented before the ’23-24 audit is finalized, the CFO told the committee. That same month, staff are preparing for the board to hear a presentation from financial advisory firm PFM on the planned borrowings needed for major renovations of North Penn High School, and how projected interest rates and bond ratings could affect those borrowings.

“In all likelihood, we will be having our ratings call with Moody’s, probably February, March, April time period of 2025. And Moody’s uses a scorecard for your bond rating,” he said.

Part of that scorecard looks at the amount a district has available in its fund balance, which has no restrictions on how the board can spent it, versus the capital reserve fund which can only be allocated toward certain large projects like capital improvements of buildings, or for purchases like school buses, the CFO said.

“It could behoove us not to transfer any money — other than the $611,000 we talked about for buses — have that surplus flow to the fund balance, and then commit that fund balance by board resolution for capital projects. That could be used for the high school project, or for other projects,” he said.

Having that surplus in the general fund could be used to lower the amount borrowed for the high school renovations, and the interest costs on such a borrowing, and specific numbers should come into focus over the next month as the audit is finalized.

“We do need to have a discussion on this at the October finance committee meeting, and make a decision. That way a resolution can be considered at the October action meeting,” Skrocki said.

Finance committee chairman Christian Fusco asked if the district had any recommendations or guidelines to follow regarding the levels of fund balance, and Skrocki said he thought that fund balance level is one reason the district is short of a AAA bond rating.

“I asked the question, at the last bond rating we had, four years ago now. They showed me the data from the AAA districts, and the percent of fund balance in their districts, compared to our percent fund balance. I think, all in, we’re somewhere around 16, 17 percent. Those districts that have a AAA rating are over 20 percent,” he said.

Of the current fund balance, the district has roughly $28 million formally committed to capital projects, which could go to the high school or other capital projects, Skrocki said. The latest version of the district’s 10-year capital plan totals roughly $174 million of smaller projects across the district, separate and apart from the roughly $260 estimate for an addition and renovations at the high school.

“We obviously have a lot of capital needs, but we do have $28 million carved out right now, committed for capital projects, and we have $22.5 million that’s unassigned,” Skrocki said.

In recent talks with PFM, he asked the financial advisor what they would suggest, and PFM advised that Moody’s would look more favorably on keeping the surplus in the fund balance, and not yet assigned to the capital reserve, due to fewer restrictions in the former. Board member Cathy McMurtrie asked about the amounts of total new money up for discussion, and Skrocki said the new funds are roughly $14 million in unexpected revenues, plus the $8 million in spending below budget, less the $611,000 in the transfer for the buses.

“Let’s just call it $21.5 million, theoretically, could be added to the fund balance,” he said.

McMurtrie said her priority would be to balance paying ahead on the high school costs and maintaining the capital project list. Skrocki answered that the current 2024-25 budget has a transfer of $6 million allocated to capital reserves for those small projects, likely to be formalized by the board in the next month or two, plus $7.6 million already allocated to that fund.

“We’ll have, let’s call it, $13.5 million in capital funds, to address the 10-year plan. Now we’re talking about the possibility of another $21 million flowing to fund balance. The board could take the approach that, we’re adding $21 million, we’re going to commit X amount of dollars to the high school, we’re going to commit X to capital projects. And you can change that, if you want to,” Skrocki said.

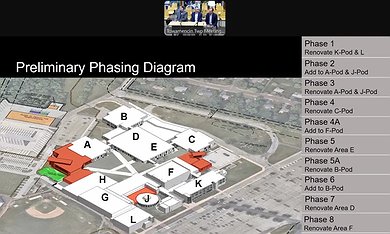

North Penn School District officials, inset, show Towamencin’s supervisors an outline of North Penn High School, the school’s various “pods” lettered, potential new additions outlined in red, and a possible renovation timeline at right, during the June 26, 2024 township supervisors meeting. (Screenshot of meeting video)

North Penn School District officials, inset, show Towamencin’s supervisors an outline of North Penn High School, the school’s various “pods” lettered, potential new additions outlined in red, and a possible renovation timeline at right, during the June 26, 2024 township supervisors meeting. (Screenshot of meeting video)Board President Tina Stoll said she thought the board were “all committed to the capital fund…and I think having the higher Moody’s rating would help us save money, with a lower interest rate.” Skrocki answered that the borrowings will increase total district debt significantly, and if the rating call helps the district maintain its current Aa1 rating would be “very successful.”

“We’re talking about borrowing, over a five or six year period, $260 million in principal. That’s a game-changer. So if we can stay at Aa1, that would be a huge victory. That’s our goal, that’s our objective, that’s going to be our ask,” he said.

“Quite honestly, the larger the fund balance, the better, when it comes to the Moody’s rating. This is taxpayer money, people were taxed on this money. I get that. But my view of this is, this can help reduce our costs, because to the extent any of this money is used for the high school, that reduces the amount of money that needs to be borrowed, and reduces the interest expense,” Skrocki said.

Fusco added that he could already hear the arguments taxpayers could make — and the answers from the board.

“I know people are going to say, ‘this should be returned to the taxpayers.’ And truly being fiscally responsible, disseminating that money out to taxpayers, versus knowing we’re going to be investing in this very large high school project, and knowing that we can get in front of some of the expenses we would need to borrow, to save those same taxpayers the interest payments down the road,” Fusco said.

Added borrowing costs by not using the surplus for the project “would almost certainly be more costly than whatever rebate we would mail home to them,” Fusco said, thus using the surplus for the fund balance – “while not the answer I’m sure most people want to hear, is actually mathematically the better choice to make for their bottom line,” he said.

North Penn’s facilities and operations committee next meets at 7 p.m. on Sept. 30, the finance committee next meets at 6 p.m. on Oct. 8, and the full board next meets at 7 p.m. on Sept. 19 at the district Educational Services Center, 401 E. Hancock Street. For more information visit www.NPenn.org.

This article appears courtesy of a content share agreement between North Penn Now and The Reporter. To read more stories like this, visit www.thereporteronline.com.