Source

Are you seeking a fast and flexible source of financing for your next California house-flipping project? A California hard money loan could be just what you need. Short-term hard money loans are not like conventional financing.

In these loans, property value is given importance over your credit history. This allows the astute real estate investor who wishes to maximize the opportunity to access capital much quicker.

This blog will show how to use hard money loans to flip houses and pointers towards maximizing profits while pushing through the competitive California real estate market.

What are Hard Money Loans?

A hard money loan is a short-term, obtained real estate loan via private lenders. It aligns very well with the specific requirements of house flippers requiring fast approval and flexible terms.

This is because the lenders are less concerned with a credit score. Instead, they focus on the value of the property and the after-repair value of the property. There is a huge demand for hard money loans in California, where the real estate market is always lively and constantly improving.

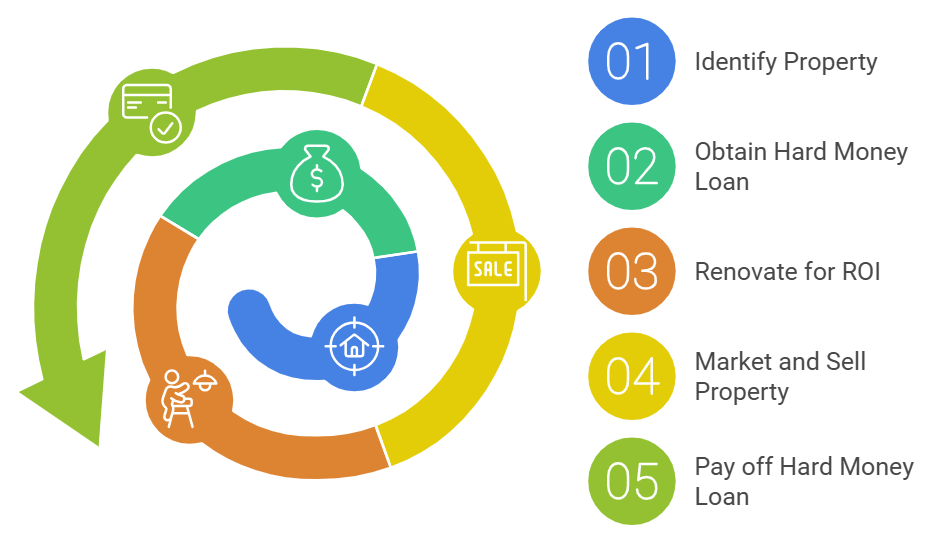

How to Flip Houses With Hard Money Loans and Maximizing Profits?

1. Identify the Right Property

The starting point for a successful house-flipping project is choosing the right piece of property. Here are the secret keys to identifying a good deal:

- Location: Choose properties in nice neighborhoods or areas that are set to be rejuvenated. Being close to schools, parks, and amenities adds resale value.

- Condition: Choose homes that need cosmetic fixes rather than reconstruction. These are easier and less expensive to repair.

- Market Value: Determine the ARV of the property. Leave plenty of room for a good profit in your purchase price and estimated renovation costs.

Understanding California housing trends is paramount to this venture. Using online sources, interview local real estate agents for additional knowledge.

2. Obtain a Hard Money Loan

You will typically need to offer quickly after finding your ideal property. Below are the steps to secure a hard money loan:

- Research on the best Hard Money Lenders in California: Identify lenders with a good reputation, competitive pricing, and experience in your target market. Look for online reviews and request some referrals.

- Gather Your Documentation: Collect critical documents, including property information, the purchase agreement, the estimated renovation costs, and your investment strategy.

- Apply: Most hard money lenders approve fast. Be ready to explain your house-flipping experience as well as your timeline.

- Property Appraisal: The lender will evaluate the property to ensure its value and ARV.

- Review Loan Terms: Attention the interest rates, fees, and payback periods closely. The hard money loan rates differ by geography in California, so they must ensure they fit within the project's budget.

3. Renovate with ROI in Mind

Renovation is one of the activities used to make a maximum profit as much as possible. Focus on improvements that go with the highest return on investment:

- Curb Appeal: First impressions matter. Landscaping, exterior painting, and new entryways can attract potential buyers.

- Cooking and Cleansing Spaces: These areas drive buyer interest. Upgrades like modern fixtures, fresh paint, and quality finishes can significantly boost appeal.

- Energy Efficiency: Installing energy-efficient appliances or insulation can add value, especially in California, where eco-friendly features are highly sought.

Create a detailed renovation budget, factoring in a 10–15% contingency for unexpected expenses.

4. Market and Sell the Property

The best way to sell quickly and at a reasonable price is to do proper marketing. The tactics to get more exposure are as follows:

- Price It Competitively: To determine a fair, attractive list price, comparable properties in the area should be researched.

- Professional Staging and Photography: Homes staged faster sell. Couple this with high-quality photos to ensure your listing stands out online.

- Leverage Multiple Channels: Property listing on MLS platforms, Zillow, and Realtor.com. Outreach can further be expanded via social media and neighborhood networking events.

- Hire an Agent: A seasoned agent can negotiate and get you a good deal closed with minimal time and energy from you.

5. Pay off the Hard Money Loan

Pay off the hard money loan as quickly as possible so that the interest costs you incur would be at their minimum. To calculate your total profit:

- Purchase price

- Renovation cost

- Loan interest and fees

- Marketing and selling costs

Pay off the loan to avoid interest charges and have free funds for your next project.

Tips on How to Maximize Profits

- Contractor Price Negotiation: Get quotations from multiple contractors to get the volume discount on materials and minimize renovation expenses.

- Keen Market Trends: Given California's liquid and dynamic market, staying current on pricing and inventory enables you to make sale points at the correct times.

- Build Your Strong Network: Connect with other California flippers, contractors, and hard money lenders by participating in local real estate investment groups. Relationships can lead to better deals and quicker project completion.

- Have an Exit Strategy: Be prepared for market shifts. If the sale materializes slowly, consider renting the property until conditions improve.

Why Hard Money Loans in California?

California is one of the hottest-moving real estate markets; there is so much potential for making significant profits. Hard money loans are structured to provide flexibility, with ease of moving swiftly on the opportunity.

Working with the best California hard money lenders, such as Munshi Capital, assures you that you have access to custom solutions addressing your unique investment goals. The drawback of high interest rates and short repayment terms won’t cramp profits if planned correctly.

Conclusion

Hard money loans allow house flippers to benefit from California's very lucrative real estate market. Picking the right lender, managing renovations very wisely, and knowing the local trends are what will turn houses over much quicker, making maximum profit.

Remember, however, that house flipping only works where one implements strategic planning and execution.

Partner with the best sources in California, namely Munshi Capital's experienced hard money lenders, understand the market and stay adaptable. This is the key to making those hard money loans a gateway to real estate success.